19+ Term life insurance

Employer group term life insurance group life insurance plans group term life insurance taxable group term life insurance table life insurance no medical exam group term life. You pay a premium for a period of time typically between 10 and 30 years.

2

20 years is often sufficient time to financially protect a family through many life milestones like paying off a.

. However the value of any coverage. Its affordable and simple it may make sense if you only want protection for the years. If you pass away your loved ones will receive a tax-free monetary death benefit.

Only after reading all the relevant information was I easily able to buy the. Term life insurance calculator premium term life. You cannot purchase a USAA term life insurance policy after the age of 70.

But the median face value rose to 110000 from 60000. However this still gives you time to consider how term life insurance could become an. Your insurance term will be good for 5 10 or even 20 years without any kind of medical proof needed.

A term policy calculator is an application you may use online to figure out how much youll need to pay in premiums for the selected life insurance and plan benefits. This is true for both men and women according to our research. Term life insurance provides coverage for a specific amount of time.

3 hours ago Term life insurance provides coverage for a specific period of time and pays out a death benefit to the beneficiary if the. Though the maximum age limit varies by company and term length most people can apply up to age 50. The average cost of term life insurance is 84 month.

A term life insurance policy is the simplest purest form of life insurance. This is based on 500000 20-year term policy based on a 18-60 year old in excellent health non-smoker. Understanding Term Life Insurance Premiums.

As an MPP the CSU provides you with 100000 of basic term life insurance coverage. The website of InsuranceDekho had all the relevant information I needed for buying a term insurance plan. A 30-year-old woman can expect to pay.

Term life is less expensive especially when you buy it early in life. A 20-year term life insurance policy is the most popular and for a good reason. The standard health rating is going to be the most common type of approval in the life insurance industry and is geared toward people who might be taking a few prescription.

Life Insurance Term Plan Calculator - If you are looking for the best life insurance quotes then look no further than our convenient service. Impact Analysis of COVID-19 on Term Life Insurance Market Term Life Insurance Capacity Production Revenue Value by Region 2022-2027 Term Life. What is a term life insurance policy.

You can also use term life insurance plan as a way to launch into purchasing. Term life has a lower upper age cap than permanent life insurance. Typically 10 15 20 or 30 years.

The percentage of Americans who have term life insurance decreased to 48 in 2019 from 52 in 1998. The CSU pays the full cost of this coverage. Term life insurance gives your family protection for a range of timeanywhere from 10 to 40 years.

2

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

/xs_and_os-5bfc2b68c9e77c00519a9e75.jpg)

When Should You Get Life Insurance

2

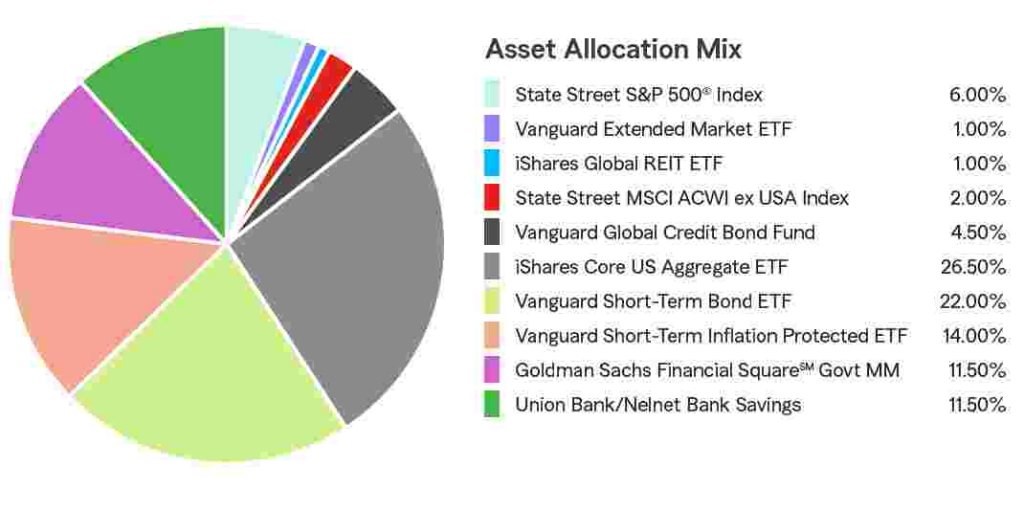

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

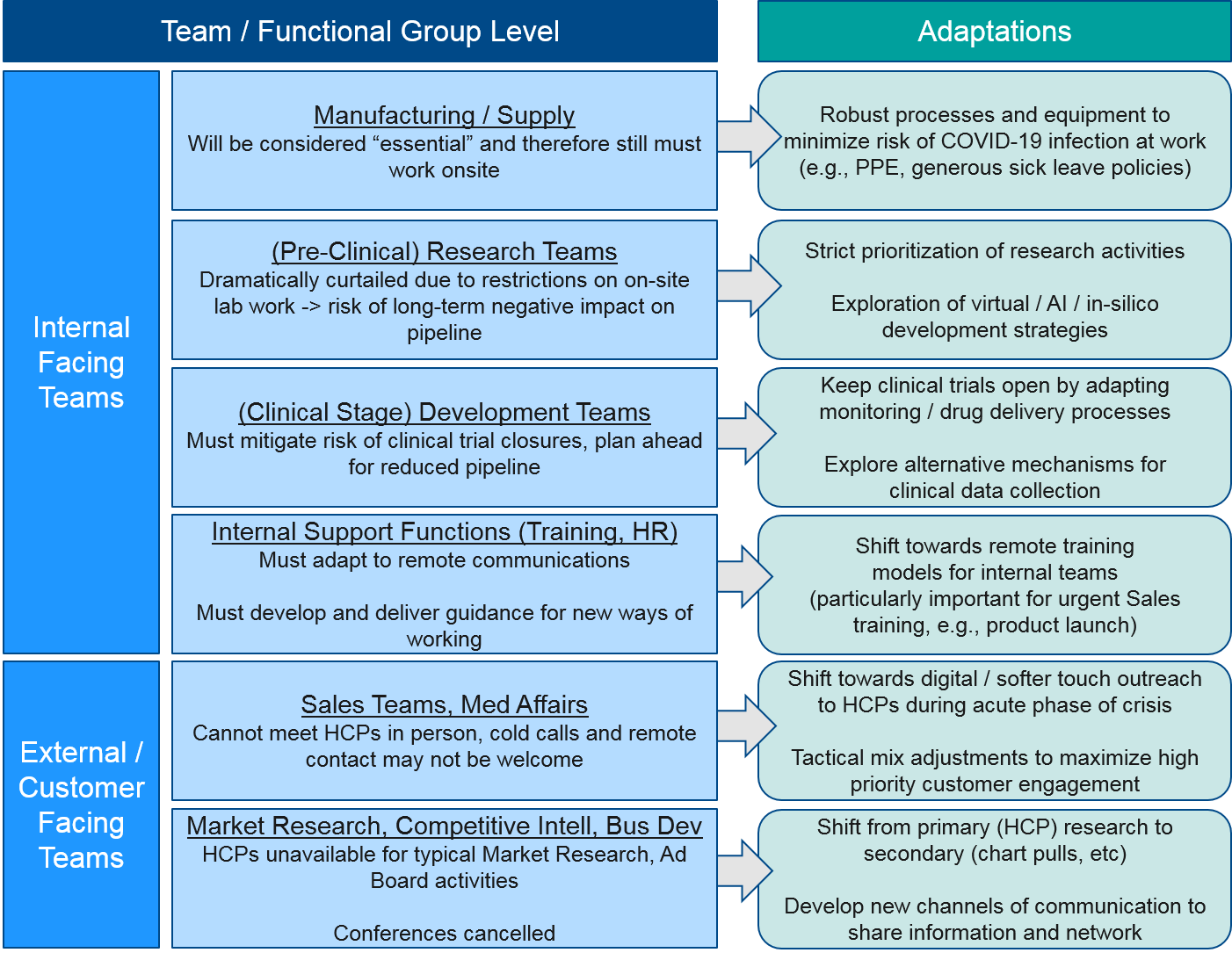

Covid 19 How Pharma Can Adapt Blue Matter Consulting

2

Insurance Coverage And Covid 19

2

How To Choose 529 Plans For Your Child S Education Moneygeek Com

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

When Should You Get Life Insurance

2

2

2

:max_bytes(150000):strip_icc()/HowDoesLifeInsuranceWork-dd125debc30e4f48bd805fdb13fc98b9.jpg)

When Should You Get Life Insurance

Covid 19 How Pharma Can Adapt Blue Matter Consulting